Charts for the Week

Please Note: The charts are for informational purposes only. The information in the charts is believed to be accurate at the time of publication. However, no guarantees are made regarding its completeness or accuracy, and the information may have changed since the time of publication. Readers should not consider the charts as personalized advice or a substitute for professional guidance and should not base any investment, financial, tax, estate, or legal decisions solely on its content.

AI | The unknown, inevitable future

February 16, 2026

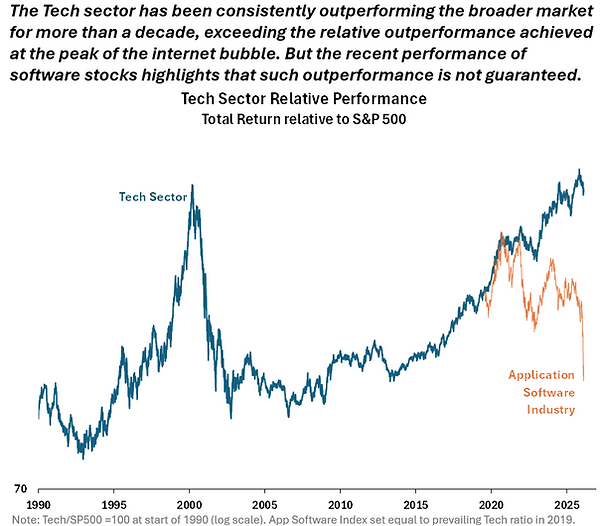

Technology bubbles thrive on an uncertain future which allows imaginative narratives to be spun about what is to come and the riches to be had. Such stories can make the future feel inevitable; although not always in a good way, as investors in software companies have learned in recent months. Even the stocks of the hyperscalers racing to own the future have come under pressure as the AI revolution is starting to feel even more discombobulating than past technological leaps with a potential end that is far from glorious.

And yet, the AI juggernaut seems unstoppable and continues to at least boost the stocks of those offering the picks and shovels for building datacenters. Given the speed at which AI is purportedly moving, the cloud of uncertainty around what it will truly bring may lift sooner rather than later – which will at least provide relief from the exhausting hype.

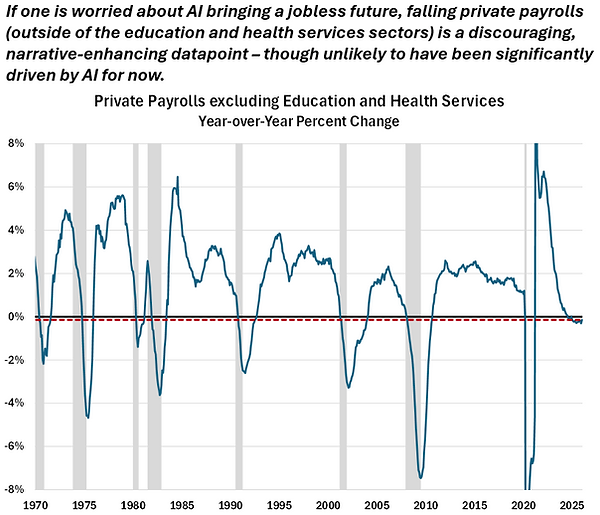

For now, recent macro-economic data has provided narrative-enhancing datapoints that we are headed towards a jobless, low-inflation future (even if AI is unlikely to have had much to do with either up to this point). Nevertheless, the combination of falling inflation, low unemployment, zero job growth, and solid GDP growth reinforces that we are living in unusual times.

Source: YCharts ; https://fred.stlouisfed.org/ ; JP Morgan ; AOWM Calculations

Crypto | Rumors of the end swirling again

February 9, 2026

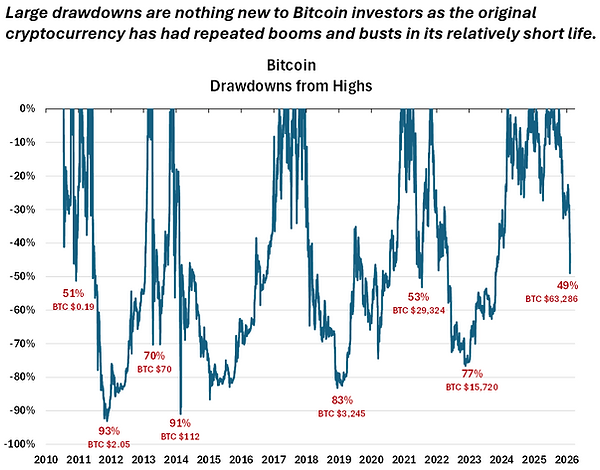

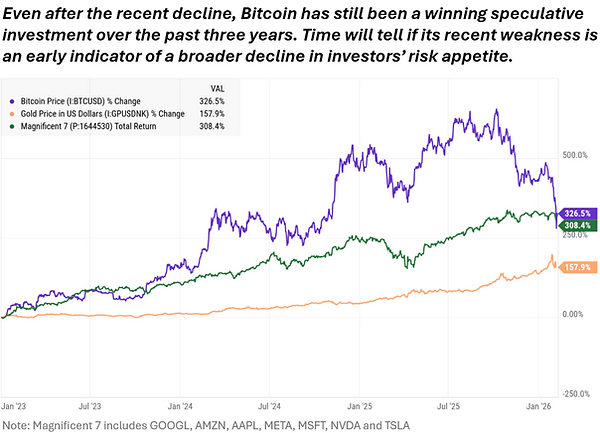

Many of the hot investments of the past few years have lost some of their luster in recent months. In particular, cryptocurrencies have experienced a large decline, losing over $2 trillion in market value since October before recovering slightly in recent days. At the low point last week, Bitcoin - the original and largest cryptocurrency - was down nearly 50% from its October high.

Such wild swings are nothing new for crypto investors. Bitcoin has had more lives than a fabled cat in its relatively short sixteen years. With each perilous fall, Bitcoin has seemed destined for the dustbin of history; however, each time, the new age gold has risen like a Phoenix to even greater heights.

The precise cause of the recent selloff is impossible to know. Perhaps it has been driven by concerns about the nomination of a new Fed Chair who is less inclined to expand the Fed’s balance sheet. Or perhaps there are growing fears that AI will eventually make cryptos easy to hack and thus worthless. Or there may just be a growing wariness among investors which shows up more quickly in the less liquid crypto markets than elsewhere.

Whatever the cause, the sell-off was unexpected for a newly accepted asset class with many apparent tailwinds – a reminder that in the short-run markets rarely act as anticipated.

Source: YCharts ; https://stooq.com/ ; https://coinmarketcap.com/ ; https://www.tradingview.com/ ; AOWM Calculations

New Fed Chair | Still a majority vote

February 2, 2026

Last week, the President nominated Kevin Warsh to be the next Chair of the Federal Reserve Board after a lengthy search. As a former Fed governor, Warsh is a noncontroversial, conventional pick who is well qualified to be the first among equals on the Fed Board and its monetary policymaking committee. Even with a new Fed Chair, however, the President is still unlikely to get the dramatically lower interest rates he desires.

Warsh has indicated that he favors lower interest rates, but he will have to convince a majority of his Fed colleagues to go along. For now, that seems likely to be a hard sell – at least beyond the two quarter-point rate cuts investors expect later this year (an expectation that was little changed after the announcement of Warsh’s nomination). If inflation remains elevated and headline GDP growth generally strong, even those anticipated cuts may not have majority support at the Fed.

In addition to not being able to deliver radically lower rates, Warsh may end up being less of a friend for the stock market than recent leaders of the Fed have been. In particular, he has been critical of the massive expansion of the Fed’s balance sheet since the 2008 financial crisis and has voiced a desire to see it reduced in size.

The monetary experiment in “quantitative easing” has generally been viewed as a positive for equity valuations – if only for psychological reasons. The markets can be reassured that any responsible taming of the Fed’s balance sheet would take years. Nevertheless, investors may still be disappointed if Warsh can persuade his colleagues that they need not break out the QE firehose to quell every fire.

Source: YCharts ; fred.stlouisfed.org ; newyorkfed.org/research/policy/rstar ; cmegroup.com/markets/interest-rates/cme-fedwatch-tool.htm ; AOWM Calculations

Risk Appetite | Still healthy

January 26, 2026

The financial markets were a little wobbly last week, but investors’ appetite for risk remains robust. Despite shifting tectonic plates that at a minimum increase uncertainty about the future, the prevailing market sentiment reflects Elon Musk’s admonition at Davos that it is better to be optimistic and wrong than pessimistic and right.

While asset valuations, credit spreads, option market activity, and margin debt all indicate that investors may be overindulging in risk, none provide a clear signal for when that might change or result in an upset stomach. If anything, some risk indicators offer reassurance that the bell has yet to be rung at the top.

For investors, optimism currently not only offers a happier outlook on life but appears to provide immeditate rewards as well. However, maintaining a long-run optimism when things go wrong is the challenge that derails the compounding returns of many.

Source: YCharts ; fred.stlouisfed.org ; BoA ; FINRA ; CBOE ; shillerata.com ; AOWM Calculations

The Economy | Two supercharged engines

January 19, 2026

AI investments and wealthy consumers are driving economic growth these days, supercharged by a high level of government stimulus which has made it easier for businesses and individuals to splurge (to a potentially destabilizing degree).

Technology-related private investments have been trending higher for decades as the world has become increasingly run by ones and zeros. However, there was a hangover after the internet bubble, and only with the recent surge in AI spending have such investments surpassed that 2000 peak as a share of the economy. And at the moment, AI investments are responsible for nearly all the growth in private investments with some segments even declining at a disconcerting rate.

To the extent there is any economic weakness, extra monetary and fiscal stimulus is on the way even though the consensus outlook is for continued steady growth. Government policies in recent years have largely eschewed the traditional wisdom of trying to be a ballast for the economy with all parties choosing to run it “hot” – fingers crossed.

Source: YCharts ; fred.stlouisfed.org ; BEA ; CBO ; AOWM Calculations

Economic Growth | Productivity growth dependent

January 12, 2026

The labor market remains an enigma. Payroll growth has ground to a halt, but the unemployment rate fell to 4.4% in December (and November’s unemployment rate was revised lower to 4.5%). Absent the addition of workers, economic growth will be solely dependent on productivity gains.

On that front, the recent data is encouraging with productivity growing at an annualized rate of 4.5% over the second and third quarters of last year. However, those strong gains were on the heels of two very weak quarters, so the longer trend still shows productivity decelerating over the past two years while payroll gains have also slowed - not exactly the advertised roaring 20s from a macro perspective.

Much enthusiasm is riding on AI generating miraculous improvements in efficiency. To date, such a miracle has not materialized in the government statistics. But it is early and the recent data will be revised many times before being deemed final, so the present may look different in the future. Till then, we can gaze back longingly at the late 1990s when the macroeconomic fundamentals at least made a tech bubble seem slightly more rational.

Source: YCharts ; fred.stlouisfed.org ; BLS ; AOWM Calculations

2025 & 2026 | Review & preview

January 5, 2026

Prognosticators were generally optimistic as last year began, and 2025 turned out largely as hoped. The economy slowed but continued to expand steadily. Unemployment ticked higher, but remained low. Inflation moderated slightly but remained stubbornly above the Fed’s 2% target. Interest rates headed lower. And the stock market climbed solidly higher as corporate profits expanded nicely.

The consensus outlook for 2026 is for more of the same: steady growth, low unemployment, falling inflation, declining interest rates, and another good year for the stock market on the back of strong earnings growth. The additional monetary and fiscal stimulus in the pipeline supports expectations for the economy and the markets to have another good year. And when the stock market has been up more than 16% in six of the last seven years, it’s hard not to assume that such high, consistent returns are the norm.

Nevertheless, with every ratchet higher of government stimulus and market valuations to historically extreme levels, caution becomes more warranted and straight-line forecasts more dubious.

Source: YCharts ; fred.stlouisfed.org ; S&P ; https://www.ustreasuryyieldcurve.com/ ; AOWM Calculations

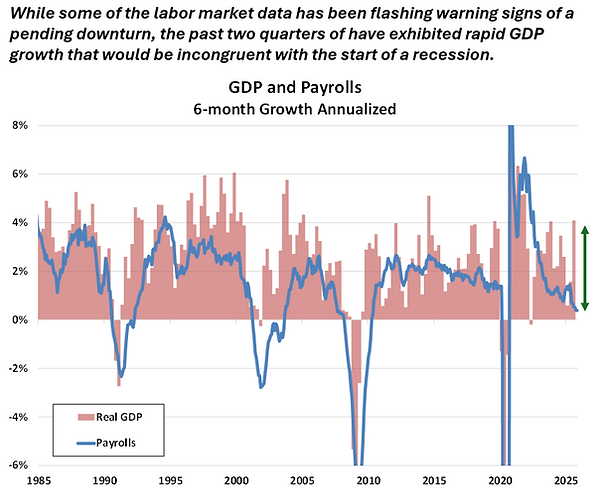

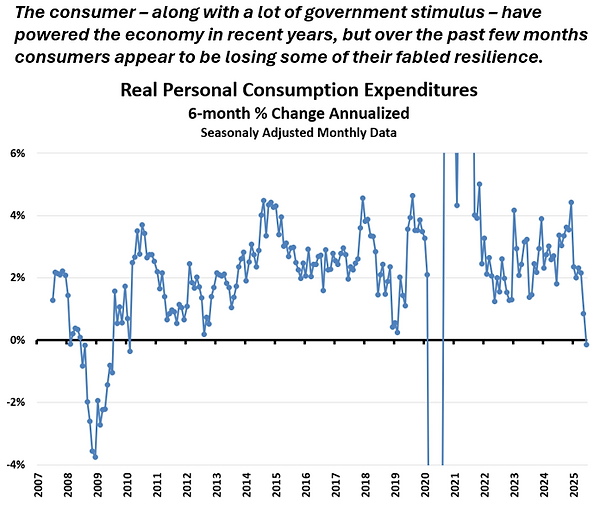

The Atlas Consumer | Still holding up the economy

December 29, 2025

The consumer continues to hold up the US economy with steady growth in spending. The US Department of Commerce estimated that Real GDP advanced at a rapid seasonally adjusted, annualized rate of 4.3% in the third quarter. While GDP growth has actually slowed over the past year, the fast growth of the past two quarters should allay recession fears fostered by the slowing labor market.

While a weak labor market could be the thing that makes the consumer pause, the risk of an imminent recession still seems low given the additional monetary and fiscal stimulus already in the pipeline for next year. The fundamental health of the economy over the long term, however, is more worrisome.

The growth in consumer spending has been dependent on a decreasingly small slice of the population and a general decline in the savings rate. At the same time, the federal government is running large deficits during a period of relative peace and prosperity. This lack of savings boosts current GDP and corporate profits, but at the risk of failing to make the investments necessary to keep the exponential growth machine going and handcuffing the government’s ability to respond to future crises. The economy’s margin for error is shrinking.

Source: YCharts ; fred.stlouisfed.org ; AOWM Calculations

Economic Data | Flowing again, even if still muddily

December 22, 2025

Government statistics for the labor market and consumer prices began flowing again last week after the shutdown interlude. On the surface, the inflation news was good and the jobs report worrisome. In reality, the opposite may be true.

Regarding the labor market, the unemployment rate has ticked up to a four-year high of 4.6% while payroll growth has stalled out in recent months. The trends in both are similar to what the economy experienced when slipping into recessions in 2001 and 2008. And yet other labor market statistics, such as claims for unemployment insurance, are not flashing the typical pre-downturn signals, offering some hope that perhaps the labor market is merely calibrating to the new normal of low population growth.

At the same time, the good news on consumer prices with headline CPI inflation falling to 2.7% is likely a statistical aberration because the shutdown prevented the usual collection of data. Such a swift decline in inflation would be more indicative of an economy in clear freefall than one just possibly sliding into a mild recession.

As has been the case since the pandemic, the data remains muddy with historical correlations decreasing in predictive value.

Source: YCharts ; fred.stlouisfed.org ; AOWM Calculations

The Fed | Becoming an AI believer

December 15, 2025

The Fed delivered the expected reduction in its target overnight interest rate last week, pushing short-term interest rates down to around 3.6%. Policymakers have now reduced rates by 1.75 percentage points since September 2024 even as inflation has remained above their 2% target, fiscal policy has remained highly stimulative, and asset valuations have continued to rise towards historical extremes.

In addition, the Fed announced it would resume growing its ample balance sheet which eliminates any pretense that monetary policy remains restrictive. The fed funds rate is still above policymakers’ median estimate of the neutral rate expected to prevail when the economy is at full strength and inflation is stable. However, after adjusting for still elevated inflation, the fed funds rate has more than likely already slipped back into stimulative territory.

In light of all the fiscal and monetary stimulus, it is reasonable that policymakers increased their forecasts for GDP growth next year. The Fed Chair also pointed to the continued strength of the consumer and ramping capital spending on AI as additional expected boosts to the economy in 2026. At the same time, policymakers less congruently reduced their expectations for inflation even while projecting an accelerating economy, banking at least in part on productivity gains aided by AI.

Our central bankers appear to be becoming AI believers just as investors are taking at least a momentary breather from the speculative frenzy. With the Fed's help, they may be back to partying before long.

Source: YCharts ; fred.stlouisfed.org ; AOWM Calculations

A Blind Cut | Insurance or accelerant?

December 8, 2025

The economic statistics that policymakers and investors rely on to guide their decisions are still not flowing as usual; nevertheless, the markets are priced for the Fed to blindly offer up another insurance rate cut this week. While headline inflation is higher now (or at least as of September) than it was when the Fed started lowering its target overnight interest rate in 2024, the markets and policymakers remain ever sanguine about the outlook for consumer prices.

There has been some growing weakness in the labor market which those pushing for lower rates view as justification for another rate cut. However, that apparent weakness may just be the new normal of minimal job growth due to aging demographics and low net migration, and more current private-sector data does not suggest a significant change in the labor market since the September jobs report.

Even if the economy is slowing, further monetary easing seems unnecessary given the fiscal stimulus in the pipeline and the strong wealth effect still emanating from the stock market.

Source: YCharts ; fred.stlouisfed.org ; https://trends.google.com/trends/ ; https://americanstaffing.net/research/asa-data-dashboard/asa-staffing-index/ ; https://www.chicagofed.org/research/data/chicago-fed-labor-market-indicators/forecast-details ; AOWM Calculations

Federal Budget | A runaway train

December 1, 2025

The federal government was shutdown in October but still managed to run a record deficit for the month. Even after adjusting for growth in the economy, the October deficit has been only exceeded in modern times by those that occurred during the great financial crisis or the pandemic.

Mandatory spending primarily on Social Security and Medicare and the growing cost of financing the federal debt drove the October deficit. Such predetermined spending has turned the federal budget into a runaway train that will not be easy to slow down.

Meanwhile, the stock market ended November on an upswing with the S&P 500 chugging higher for the seventh straight month as investors cheered the growing signs that the Fed might reduce its target overnight interest rate again in December after all. However, despite continued good corporate profits and the prospects for even more government stimulus, the breadth of the current bull market continues to wane.

Source: YCharts ; fred.stlouisfed.org ; US Treasury ; https://www.cbo.gov/ ; https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview ; AOWM Calculations

Japan | Foreshocks or benign rumbles?

November 24, 2025

Japan’s economy contracted in the third quarter, and the new Prime Minister put forth an aggressive fiscal stimulus package to boost growth. The market response was not enthusiastic – Japanese stocks sold off, its long-term interest rates climbed higher, and the yen depreciated.

Ever more fiscal and monetary stimulus has been the playbook for policymakers over the past few decades and is likely to remain so until such policies unambiguously make things worse. At which point, there may be no easy escape from the excesses of the past. Where exactly the line lies between productive stimulus and a financial reckoning is unclear and is at least partly determined by the fickle psychology of the financial markets.

Given its high level of debt and extreme monetary policy, Japan has provided comfort for some time that other developed countries are far from trouble. But Japan may be a bad reference point with unique characteristics that have enabled it to stretch policy further than others can. Even if it is a good benchmark, a disturbance in the east could still quickly change the market’s permissive mood of recent years and move the line of reckoning for everyone else closer.

Source: YCharts ; fred.stlouisfed.org ; mof.go.jp/english ; AOWM Calculations

Euphoria's End | Always a half life away

November 17, 2025

The stock market is struggling to regain its upward momentum with declining expectations for another Fed rate cut in December playing at least some part. Yet more monetary and fiscal stimulus in the coming months could very well keep stocks rolling higher next year.

That a financial reckoning is on the horizon seems certain. But much like the highly anticipated recession in recent years that never arrived, perhaps valuations and profit margins will never mean revert. The already frothy markets are set to get a fresh boost of fiscal stimulus next year as the tax refund season should be a happy one for many, and the Supreme Court may force the Administration to throw in some unexpected tariff refunds as well. Meanwhile, the Fed, even if it doesn’t reduce rates in December, is still poised to reduce short-term rates further next year and resume growing its ample balance sheet.

All this government largess is wonderful until it isn’t. The end of the current euphoric market can only be put off forever in theory.

Source: YCharts ; fred.stlouisfed.org ; CBO.gov ; cmegroup.com ; Ray Dalio ; hussmanfunds.com ; AOWM Calculations

AI Bubble | What inning is it?

November 10, 2025

Last week, the behemoths sitting atop the stock market experienced some discombobulating selling pressure for the first time in months despite turning in generally good earnings reports. While optimism in the market remains high, the mild pullback may be indicative of some budding concerns that the hockey-stick projections for AI are not likely to be realized and that the hundreds of billions already spent will never generate good returns.

Some of the announcements for gigantic AI investments and complex interlocking deals amongst the major players are made with such opaqueness and audacity that they can’t help but generate skepticism. In addition, the markets have been weighed down in recent weeks by both the lengthy government shutdown that has deprived investors of the regular flow of economic data and the persistently dour economic outlook of many Americans.

Increasing levels of caution also seem reasonable in light of high valuations and a slowdown in the long-run uptrend in the market which suggest we are in the late innings of the current mania; however, excessive government stimulus and the wealth of the tech oligarchs could keep the game going into extra innings for the foreseeable future. At a minimum, the market is unlikely to commence a sustained downturn as long as corporate profits continue to march higher as they have so far this year. In an ideal world, stock prices would merely pause long enough to let the fundamentals catch up - there's a first time for everything.

Source: YCharts ; fred.stlouisfed.org ; topdowncharts.com ; www.spglobal.com/spdji/en/indices/equity/sp-500/#overview ; shillerdata.com ; data.sca.isr.umich.edu ; AOWM Calculations

The Fed | Slouching towards fiscal dominance

November 3, 2025

Policymakers at the Fed met last week and reduced their target overnight interest rate for the second meeting in a row. While Jay Powell, the Chair of the Fed, hedged a little on the prospects of another rate cut in December, the Fed did announce that it would stop shrinking its balance sheet next month, which should boost the amount of cash flowing through the financial system.

The stagnant labor market has provided policymakers with a fig leaf of cover to loosen monetary policy despite inflation trending higher, a seemingly resilient economy, euphoric financial markets, and excessive fiscal stimulus being pumped ceaselessly out of the nation’s capital. No self-respecting central banker would ever admit that the Fed is giving up the independence it won from the U.S. Treasury seventy-four years ago, but the writing does appear to be on the wall.

A grand bargain between the Fed and the Treasury where compliant monetary policy is pursued in conjunction with a prudent federal budget could be a good solution for the imbalances plaguing the economy. However, abdicating the Fed's independence without establishing a sustainable fiscal path forward is unlikely to solve anything.

Source: YCharts ; fred.stlouisfed.org ; www.atlantafed.org/cqer/research/gdpnow.aspx ; AOWM Calculations

Gold | Speculating on inevitable inflation and fear?

October 27, 2025

Despite a pullback last week, gold has been surging in value over the past three years, up nearly 150% while the doddering S&P 500 is up less than 80%. Gold is the quintessential fear trade that investors run to when the world appears to be falling apart, but the oldest financial asset is not immune to speculative fevers – they just don’t normally occur when the stock market is also melting up.

The fundamental underpinnings pushing gold higher are concerns about the systemic imbalances in the economy, an inflationary debasement of the dollar, and the de-dollarization of the world economy. General fear is also still likely playing a role – or at least narratives on how best to hedge the panic that seems inevitable to strike financial markets that are flying so close to the sun.

Gold is not only moving oddly relative to the stock market these days. For most of the past few decades, gold prices and the real yield on Treasury Inflation-Protected Securities (TIPS) moved in opposite directions, as gold is a more logical inflation hedge when real yields are low or negative than when TIPS offer a good real yield. That negative correlation has completely broken down over the past three years. TIPS with real long-term yields around 2% still appear to be the better - if less exciting - inflation hedge versus an asset with negative carrying cost and a spotty record of successfully hedging against inflation. However, if there is a complete breakdown in governmental institutions in the US, a shiny pet rock could be the emotional support animal we all need.

Source: YCharts ; fred.stlouisfed.org ; AOWM Calculations

Leverage | Every round goes higher, higher

October 20, 2025

Another year, another $2 trillion in borrowing by the federal government. Despite solid growth in tax receipts, new tariff revenue and efforts to curtail spending, the federal budget remained woefully out of balance in the 2025 fiscal year that ended on September 30.

The dysfunction that has kept the federal government shut so far this fiscal year does not bode well for the bi-partisanship needed to proactively address the nation’s fiscal imbalances. Whenever the next crisis inevitable comes, the powers-that-be will likely attempt again to flood the system with ever more borrowed (and/or printed) money, and it may yet work – or at least not result in catastrophe. But the results of the last attempt to do so warn that we may be reaching the top of the decades-long debt super cycle.

Even if the economy can lever up another leg higher without dire consequences, the extreme government stimulus is still fomenting trouble in the financial markets, which are busy levering up themselves in old and novel ways.

Source: YCharts ; fred.stlouisfed.org ; FINRA ; CBOE ; AOWM Calculations

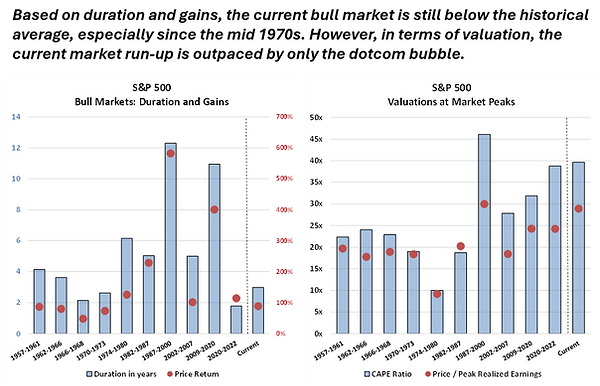

Bull Market | Turns three

October 13, 2025

The current bull market celebrated its third birthday with a bit of a tantrum on Friday. It was the first real bump in the road the market has experienced since the steep sell-off in April over tariff fears.

Having had only the smallest downtick to feast on in recent months, dip-buyers likely salivated all weekend at the chance to seize on the deals offered up by Friday’s decline. While this could be the beginning of the end of the market’s epic run, it is likely not the end just yet, so dip-buyers may still be rewarded for a while.

Compared to past bull markets – which are arbitrarily marked by periods following drawdowns of at least 20% – the current rally is still below average in terms of duration and gains; however, in terms of valuations, only the dotcom bubble surpasses it. The US stock market has arguably been in one long cyclical bull market since 2009, much like the run in the market from the early 1980s to the peak in 2000.

Comparisons to the late 1990s are ubiquitous these days. While the technology is potentially even more transformational this time around, the macroeconomic background is definitively less healthy, making walking on air even more risky.

Source: YCharts ; fred.stlouisfed.org ; www.dallasfed.org/research/economics/2025/1009 ; AOWM Calculations

Investor Sentiment | Too hot? (same question as last October)

October 6, 2025

Investor enthusiasm is best in moderation; however, like many things, little time is spent at the golden mean. The market’s animal spirits are more often running from one extreme to the next. Since the bottom of the great financial crisis in 2009, investors have been growing steadily more confident and carefree with the few brief hiccups experienced only serving to strengthen their resolve to buy every dip.

In an ideal scenario: the market is running slightly above its long-run moving averages which are trending nicely higher (but not too quickly); earnings expectations are trending higher optimistically (but not overly so); valuations are reasonable (or better yet cheap); no one theme is monopolizing the market narrative; equity allocations are near historical averages (or below but trending back up); margin debt is growing slowly; and options activity is not noteworthy. These days investor sentiment is running impatiently away from the ideal.

Accordingly, stocks kept churning higher last week despite a government shutdown (or perhaps in part because of it as the shutdown also stopped the release of any government data that might disrupt the current bullish zeitgeist). But the shutdown won’t stop the upcoming release of quarterly corporate earnings for which expectations have been rising.

Source: YCharts ; fred.stlouisfed.org ; S&P Global, AOWM Calculations

Spending | Even more resilient than prior estimates

September 29, 2025

Economic growth in the second quarter was revised higher again driven by stronger consumer spending than initially estimated. The annual update to the GDP data going back five years also revised up estimates for personal consumption over the past two years.

Through the first half of the year, it had appeared that the consumer was starting to slow down, but the revisions and monthly data through August suggests that is not the case – which remains at odds with the low level of consumer sentiment. The survey data may be partly explained by only the top of the income ladder really enjoying much growth in real spending.

Much like the concentrated stock market, the narrow strength of the economy makes it more fragile. Nevertheless, the flywheel spins on and is still expected - despite its resilient speed - to get an extra push from the Fed in the coming months.

Source: YCharts ; fred.stlouisfed.org ; Moody's Analytics ; Morning Consult ; BEA ; AOWM Calculations

Rate Cuts | Not the textbook response

September 22, 2025

The financial markets are exhibiting speculative froth; inflation is trending higher; unemployment remains low; policymakers are raising their forecasts for inflation and GDP growth; and the Fed just cut its target overnight interest rate and indicated more reductions are likely in the coming months. That is not the textbook policy response to the delineated economic conditions.

Nevertheless, investors are expecting even more unorthodox rate reductions than projected. Policymakers’ median forecast is for the fed funds rate to fall to 3.4% next year while the market is priced for short-term rates to decline below 3%.

Given the stock market’s positive response to the Fed’s latest policy announcement, the expectation for greater rate cuts does not appear to be driven by a fear of recession – which would be a more textbook rationale for lowering rates. Meanwhile, in the bond market, long-term interest rates ticked higher last week, also indicative of minimal recession concerns (but potentially some lingering inflation worries).

If the economy remains generally healthy and the federal deficit robust, the level of monetary easing projected by either policymakers or investors could prove to be counterproductive.

Source: YCharts ; fred.stlouisfed.org ; Moody's Analytics ; AOWM Calculations

The Fed | A predictable future?

September 15, 2025

The latest CPI report showed inflation continuing to trend in the wrong direction; nevertheless, the financial markets are fully priced for the Fed to begin cutting its target overnight interest rate again this week. Not doing so would be truly surprising, and central bankers these days dread being surprising even more than being wrong.

While stock valuations remain stretched at historically high levels, additional monetary easing could supply the fuel necessary to keep the upward momentum going - a potentially self-fulfilling belief at least in the short run. Meanwhile in the bond market, a general anticipation that the Fed will ultimately be fully co-opted to assist with financing the federal debt may be keeping long-run Treasury rates in check despite a deficit that seems untamable.

Both are reasonable expectations; however, it is wise not to place too much faith in our predictive powers.

Source: YCharts ; fred.stlouisfed.org ; AOWM Calculations

Jobs Report | Newsworthy repetition

September 8, 2025

The latest jobs report was newsworthy, but the story it told was much the same as it has been telling for over a year. The market swung up and then down on the newsworthy part, first cheering the prospects of the report prompting the Fed to lower rates more aggressively and then worrying about why the Fed might need to cut rates more aggressively.

On the newsworthy side, revisions to the payroll data indicated that payrolls actually declined in June for the first time since 2020 and the unemployment rate ticked up in August to 4.3% - the highest since October 2021. And yet the report mainly repeated the longstanding narrative of an unusually stagnant private labor market that is neither shrinking nor really growing – which given the nation’s increasingly stagnant population is all that has been necessary to keep the labor market largely in balance.

Investors continue to anticipate a goldilocks scenario where the labor market continues to weaken sufficiently to encourage the Fed to lower rates but doesn’t suffer a significant downturn. That outlook largely ignores how policymakers may be constrained from cutting rates by high inflation – or the potential ramifications of failing to be so constrained.

Source: YCharts ; fred.stlouisfed.org ; topdowncharts.com ; www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html ; AOWM Calculations

Corporate Profits | No worries, but for the k-shape

September 1, 2025

At the national level, corporate profitability remained strong in the second quarter showing no signs indicative of an economy in or near a recession. However, much like with the consumer, the wealthiest companies have been thriving while the rest have not.

Corporate profits soared across the board after the pandemic on the back of massive government stimulus. Since then, most of the gains have gone to the biggest companies -- which has been the fundamental basis for the increasing concentration of the stock market over the past few years.

The current hope is that lower interest rates and a more friendly regulatory environment will enable more companies to boost earnings as the largest see their torrid growth slow to a merely robust mid-teens rate. A broadening of corporate profit growth would provide a firmer foundation for the economy and the market.

Source: YCharts ; fred.stlouisfed.org ; www.spglobal.com/spdji/en/indices/equity/sp-500/#overview ; AOWM Calculations

Lower Rates | Then what?

August 25, 2025

The Fed Chair gave a speech on Friday, and the financial markets cheered the prospect of lower interest rates. Time will tell. Investors have repeatedly anticipated rate cuts that have failed to materialize, and economic data over the next month could change the outlook yet again. Even if the Fed does lower its target overnight rate a bit more, it is far from clear in this up-is-down world how stimulating that really would be for the economy.

First, asset valuations are already “notable” (to use the Fed’s own term in its latest assessment of financial stability). So while further easing risks making things more unstable, further upside stimulus through the wealth effect is limited.

Second, lower short-term rates do not guarantee that long-term rates will follow. Since the Fed first cut rates last September, long-term Treasury, corporate and mortgage rates are all higher.

Third, higher interest rates have yet to hinder corporate America significantly as companies had loaded up on ultra-low-rate debt during the pandemic, which is only slowly being refinanced at higher rates. That normalization process will continue to be a headwind for companies in the coming years unless the Fed takes monetary policy back to extreme levels with zero percent rates and a large expansion of its balance sheet.

Lastly, this is the first significant tightening and loosening cycle of monetary policy with the Fed paying interest on oversized liabilities - which makes the Fed’s rate moves less countercyclical as the Fed injects billions into the financial system via interest payments as rates go up and conversely reduces that stimulus as rates come down. Similarly, lower short-term rates would also slightly bring down the interest expense on the national debt and the federal deficit, mildly reducing that generous stimulative boost to consumer spending and corporate profits.

Given all we have seen in recent years, it is hard to see how anyone is confident about what comes next.

Source: YCharts ; fred.stlouisfed.org ; federalreserve.gov ; econforecasting.com/forecast/ffr ; AOWM Calculations

Central Bankers | Anchored to easy money

August 18, 2025

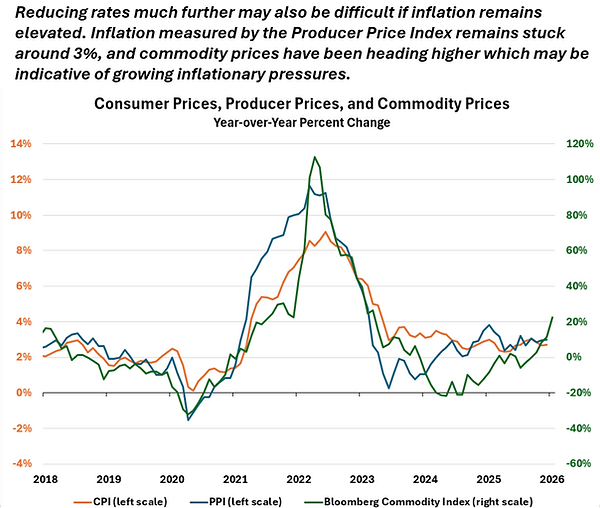

Inflation continues to complicate the desire for lower interest rates. CPI inflation crept higher in July while the Producer Price Index spiked significantly higher than expected. Nevertheless, the market remains fully priced for the Fed to resume cutting its target overnight interest rate in September.

Fed policymakers profess a dual mandate to “achieve maximum employment and inflation at the rate of 2 percent over the longer run.” Putting aside quibbles about the Fed’s actual statutory mandate and what monetary policy can achieve, the status of the economy relative to those two stated goals alone is at odds with the expectation for an imminent easing of policy. The unemployment rate remains low at 4.2% in line with estimates for full employment (assuming an inherent level of frictional unemployment in the economy) while inflation remains stubbornly above the Fed’s definition of “stable prices” as it has for more than four years.

However, the crises and conditions of the past few decades have ingrained a bias towards loose monetary policy – which a slowing economy, weakening labor market and burgeoning national debt only make more challenging for policymakers to overcome.

Source: YCharts ; fred.stlouisfed.org ; AOWM Calculations

Stocks | Stretching the imagination

August 11, 2025

The S&P 500 finished last week a tick below its all-time high while the Nasdaq continues to march steadily higher into uncharted territory. By almost all metrics, the valuations of US large cap stocks have outpaced the fundamentals. And by some metrics, the US stock market has never been so richly valued or so concentrated as it is today.

Such manic moments stretch the imagination for how wild they can get. When Microsoft’s valuation topped out around 6% of GDP at the peak of the dotcom bubble in 2000, one might have imagined that was a reasonable benchmark for an extreme valuation (especially after it fell back to less than 1% of GDP in 2009). But Microsoft – the one company to enjoy both the heights of the dotcom and pandemic/AI bubbles – blew past that quaint 6% marker in 2020; and then it appeared 10% in 2021 might be the new peak; and then almost 12% last year; however, after the recent run-up from the April low, Microsoft is now valued at around 13% of GDP -- and some assert we’re just getting this speculative frenzy warmed up.

Who’s to say where this stops? But if the dotcom bubble is any guide, the end can be abrupt with today’s insatiable appetite quickly becoming tomorrow’s regrettable stomachache.

Source: YCharts ; fred.stlouisfed.org ; Augur Infinity ; AOWM Calculations

Economic News | Summer deluge

August 4, 2025

In the dead of summer last week, there was a deluge of economic news. In addition to the ongoing back and forth over tariffs, there was a bevy of earnings reports including four of the so called “Magnificent Seven” mega-cap stocks; the latest GDP numbers were released along with reports on the Fed’s preferred PCE inflation metric and the labor market; and policymakers at the Fed announced their latest decision to keep the fed funds rate unchanged. On net, the news gave investors pause as the stock market gave back some of its recent gains and long-term interest rates declined.

With respect to the economy, growth slowed further in the second quarter as consumer spending has stalled over the first half of the year. Estimates of job growth also continued to decelerate driven in large part by a downward revision in government jobs, but the unemployment rate remained relatively low at 4.2% given the changing demographics of the country requiring fewer jobs to maintain full employment. At the same time, PCE inflation picked up in July and continued to trend away from the Fed’s 2% target.

Policymakers and investors could be facing the odd mix of an economic downturn, low unemployment, and high inflation. Given the frothy state of asset prices, the steady growth of the money supply, and the Fed’s mandate to focus on employment and inflation (not GDP growth), the case for further rate cuts is weak. However, additional cuts are likely before year end. And yet, it is dubious that further monetary easing will give the economy enough of a boost to achieve investors’ lofty earnings expectations which remain incongruent with slowing GDP growth.

Source: YCharts ; fred.stlouisfed.org ; BLS ; BEA ; AOWM Calculations

AI | Necessarily disruptive

July 28, 2025

If it feels like the pace of change is accelerating, that is because it is. We are reaching the second half of the proverbial chessboard where exponential growth can be particularly discombobulating and hard to fathom. Advances that were once experienced over a lifetime just a generation ago now zoom by in a matter of years or seemingly months.

Perpetual growth is taken for granted (especially in current asset valuations); however, it has required repeated technological discoveries to overcome past constraints. The compounding of human knowledge, of which AI is the latest and potentially ultimate culmination, has thus far enabled humanity to leap over every hurdle. The increasing challenge is that as things move faster and faster, the hurdles come at us faster as well, and the pain of a potential tumble also grows.

Despite the increasing speed, the margins for safety have been worn perilously thin with high asset valuations, elevated leverage, and low levels of societal trust. AI’s biggest hurdle to keeping the world growing may not be finite resources but humanity’s hubris.

Source: YCharts ; fred.stlouisfed.org ; www.eia.gov ; www.energy.gov ; JP Morgan ; Scale by Geoffrey West ; United Nations ; AOWM Calculations

Inflation | Why worry?

July 21, 2025

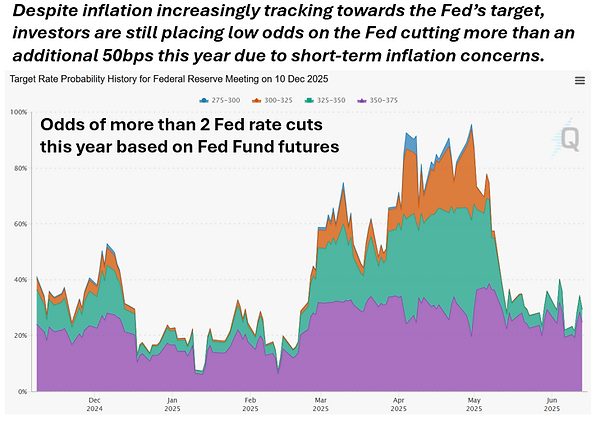

After three months of relatively benign inflation reports, CPI inflation reaccelerated in June, and the consensus forecast is that tariffs will keep inflation trending further away from the Fed’s 2% target in the coming months. Despite rising inflation and increasing inflation expectations in the TIPS market, investors still expect the Fed will reduce its target overnight interest rate by half a percentage point before the end of the year.

There is a growing chorus of pressure for the Fed to move sooner rather than later with the expectation that any tariff-induced inflation will be transitory. More traditional voices advocating for looser monetary policy believe the economy is weakening quickly and in need of lower rates to avoid a recession. Others assert that the coming AI revolution is going to be so deflationary with unprecedented supply-side growth that the Fed doesn’t need to worry about inflation.

In addition, the president has been blunt in his desire for the Fed to help lower the interest expense of the federal debt. The pressure campaign from the president suggests the independence of the Fed may be on borrowed time – which would be a logical reason to worry about inflation if it is not simultaneously coordinated with a significant reduction in the federal deficit.

Source: YCharts ; fred.stlouisfed.org ; fiscaldata.treasury.gov/datasets/monthly-statement-public-debt/summary-of-treasury-securities-outstanding ; AOWM Calculations

AI Fever | It's summertime

July 14, 2025

Last week, Nvidia became the first company to reach a $4 trillion market valuation. It is becoming a summer tradition for Nvidia to celebrate such milestones as it cracked the $1 trillion level in June 2023 and the $3 trillion level in June 2024. It has been an astonishing run for the business and even more so for the stock. It is fitting that one of the biggest FOMO trades of all time has a name derived from the Latin word for envy.

Is it too late to join the party? It seems unlikely Nvidia will be hitting $5 or $6 trillion next summer, but it was hard to imagine it reaching this level, even just a few months ago after it had swiftly lost 35% of its value to start the year. Policymakers could help to keep the music playing for a while. If the Fed lowers rates later this year when the market is still running hot, momentum could carry things to more extreme levels.

However, even if AI is as magical as its biggest proponents assert, Nvidia has reached a valuation where both economic and political headwinds will depress long-run returns. Is Nvidia likely to grow (or be allowed to grow) to be worth more than 20% of GDP a decade from now – which is what a 10% annualized return from here would likely imply? Is it likely to even still be worth the more than 13% of GDP that it is now? History would suggest not.

As indicated by its extreme volatility, Nvidia has been more a trade than a buy-and-hold stock for some time. So far shareholders have only been really rewarded if they have been brave (foolish?) enough to sell. When to get off such a speculative juggernaut is the hardest part for those fortunate enough to be on it and is fraught with as much potential regret as those who never bought the stock.

Source: YCharts ; AOWM Calculations

The Government | Sails at full speed

July 7, 2025

The federal government has been providing high levels of economic stimulus for seventeen years. During some of those years, the stimulus was warranted. However, the indiscriminate use of loose monetary and fiscal policy outside of periods of crisis has amplified imbalances and diminished the government’s ability to provide stability in rough seas.

The government has historically served as a counterbalance to the prevailing economic and financial winds – slightly trimming the sails in good times and easing them in bad times. In recent years, caution has been thrown overboard with the sails put at full speed despite low unemployment, high inflation, and elevated asset valuations.

Policymakers of all stripes have always been inclined to defer hard choices and bank on a growth miracle. But we may be approaching the limits of how much the ship of state can be pushed to sail faster in the hopes of skirting through troubled waters unscathed.

Source: YCharts ; fred.stlouisfed.org ; shillerdata.com ; www.spglobal.com/spdji/en/indices/equity/sp-500/#overview ; AOWM Calculations

Stocks | The party goes on

June 30, 2025

The S&P 500 notched a new all-time high on Friday for the first time since February 19. The intervening 89 trading days were eventful with the market falling nearly 20% before rebounding at a record pace, bolstering the faith that any dip in the market is a buying opportunity.

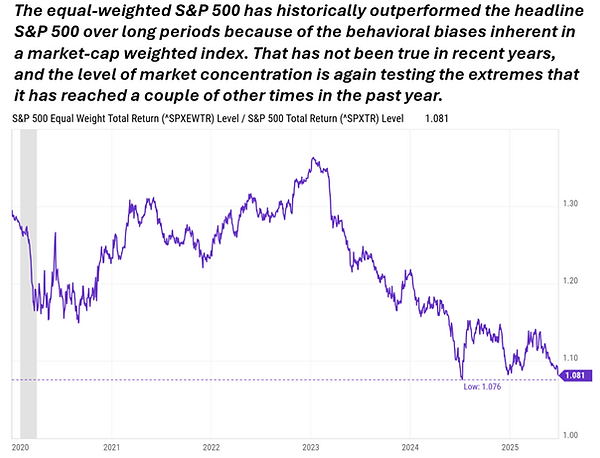

The last time the market so quickly hit a new high after falling more than 15% was 1998. From there, the S&P 500 ran up another 28% in an increasingly concentrated fashion before the dotcom bubble burst. A similar rally from here seems unlikely given the high valuations and level of concentration that already exists, but it is certainly not out of the realm of possibility if the world remains relatively stable and nothing disrupts the AI narrative.

And if the market does keep trending higher, it could easily become even more concentrated thanks to the growth in passive index funds and the falling US dollar. Passive funds by design pump the most money into the largest stocks regardless of fundamentals while a falling US dollar provides a little fundamental boost to the multinational mega caps that generate a large amount of their revenue outside the US. In the long run, the dominance of passive index funds and a weak dollar do not bode well for the market, but that is a worry for another day. For now, the party goes on.

Source: YCharts ; https://insight.factset.com/ ; www.researchaffiliates.com/publications/articles/1078-passive-aggressive-risks-of-passive-dominance ; AOWM Calculations

The Fed | Projecting transitory stagflation

June 23, 2025

The Fed’s policy committee had its fourth meeting of the year last week and kept its target overnight interest rate unchanged at 4.33% where it has been since December. The median forecast of policymakers is for the US economy to suffer the unhappy combination of slower growth and higher inflation in the coming months.

Despite the Fed’s 2% inflation target remaining elusive, a slim majority of policymakers still penciled in a couple more rate cuts this year in the expectation that a tariff-induced wave of inflation will quickly recede. A potential jump in oil prices could add additional inflationary pressures in the coming months. It would be unusual for the Fed to cut rates while inflation is rising; however, if the economy continues to weaken, once again banking on inflation being transitory will be the path of least resistance for policymakers.

Most central banks around the globe have already lowered rates this year. As a result, US monetary policy is tighter than other developed countries, but it is not particularly restrictive, especially relative to US fiscal policy which continues to provide a destabilizing level of stimulus to the economy.

Given the extreme fiscal and monetary stimulus of recent years, one of the biggest risks facing the markets and the economy is that there won’t be any effective government stimulus left in the tank when really needed.

Source: YCharts ; https://fred.stlouisfed.org/ ; conference-board.org/topics/us-leading-indicators ; economist.com ; AOWM Calculations

Geopolitical Events | Do they matter?

June 16, 2025

The world is always in turmoil, and the stock market has marched higher through troubled times repeatedly. Nevertheless, recent events should give even the most intrepid climber of the wall of worry some pause, especially given current market valuations which imply a high level of systemic complacency about numerous growing risks.

The US stock market has been on one of those runs since the bottom of the great financial crisis in 2009 that can make investors feel invincible. It has been over 16 years since there has been any sustained market downturn. With every pullback that is quickly recovered, stocks increasingly look like an investment that can’t lose.

But geopolitical events and equity returns are not guaranteed to turn out well. Stocks have historically earned good long-run returns in large part for that very reason. Investing requires a belief that tomorrow will be better than today; however, the more investors discount how bumpy the path to a more prosperous future could be, the more consequential unexpected events can become, and the lower future returns will be under even the best of scenarios.

Source: YCharts ; https://fred.stlouisfed.org/ ; cmegroup.com ; shillerdata.com ; AOWM Calculations

Labor Market | Slow-motion slowdown

June 9, 2025

The stock market cheered the latest jobs report as payrolls increased for the 53rd consecutive month. But despite the market's response, the labor market remains in a slow-motion slowdown as year-over-year payroll growth inched lower to 1.1% and previous months’ estimates were again revised lower.

With the unemployment rate still at 4.2%, the labor market remains simultaneously strong and stagnant. In the current uncertain economic environment, companies are hesitant to fire or hire workers. The recent decline in CEO confidence is unlikely to change that dynamic.

Even if the economy slows further, the labor market could remain tighter than it has in past downturns if there is a retrenchment in foreign-born workers who now make up nearly a fifth of the labor force. In addition, the demographics in the US are slowing the growth of available workers which could also help keep unemployment low in a weak economy.

A structurally tight labor market would seem to free the Fed to focus on inflation if it but weren't for the pesky mountain of federal debt.

Source: YCharts ; https://fred.stlouisfed.org/ ; www.conference-board.org/topics/ceo-confidence ; taxtracking.com ; AOWM Calculations

Trade Data | Obscuring the economic picture

June 2, 2025

The front-running of tariffs last quarter pushed the trade deficit to a record level and caused real GDP to decline. This quarter, the reverse is happening as companies use up those recent imports and hope the tariffs will be gone before their inventories run dry. The whipsawing trade deficit made a good economy in the first quarter look weak and may make a slowing economy look stronger than it is in the second quarter.

Beneath the volatile headline GDP numbers, the consumer and the government remain steady spenders, and a recession will likely be avoided as long as that is the case. Banks have started to tighten credit again, but the financial markets across the board indicate a sanguine investor sentiment about the economic outlook. The fears of April already seem to be a distant memory.

Economic expansions usually end when imbalances grow to the breaking point or the Fed attempts to intervene before they do. It is clear where the biggest imbalances lie today, but less clear is when something will break or what the ultimate trigger will be. For now, the music is still playing, and the dance goes on.

Source: YCharts ; https://fred.stlouisfed.org/ ; www.atlantafed.org/cqer/research/gdpnow.aspx ; www.dallasfed.org/research/wei ; AOWM Calculations

Fiscal Stimulus | Vanishing returns

May 26, 2025

The financial markets got a little yippee again last week. The House passed a budget bill that largely maintains the unsustainable status quo of elevated federal deficits, and the president revived concerns about tariffs.

The stock market has benefited from the fiscal excess that Congress has doled out over the past quarter century, but the returns on such stimulus may be vanishing. While taxing imports could help to address the government’s fiscal imbalance, tariffs are an unreliable source of long-run funding without being codified by Congress. Plus, any new revenue could be more than offset by higher interest expense on the federal debt that results from tariffs reducing foreign demand for Treasurys.

The markets will likely need to get significantly more yippee to focus the mind of Congress, which appears disinclined to begin making the tough political decisions necessary to place the nation on a sustainable fiscal path.

Source: YCharts ; https://fred.stlouisfed.org/ ; cbo.gov ; AOWM Calculations

Good times | Not buying happiness

May 19, 2025

Inflation has fallen to its lowest level in four years, unemployment remains low, the stock market is back to within striking distance of its all-time high, and consumer sentiment is cratering to near all-time lows. In the current day, it is difficult to know how much weight to place on survey data; however, the persistent and growing divergence between the headline economic data and how individuals report feeling about their prospects is striking. Eventually one would think that depressed consumers would show up in the economic data, but for now folks appear inclined to continue their retail therapy.

Nevertheless, the further decline in consumer sentiment even as the stock market has recovered quickly from its April swoon is unusual and perhaps a cautionary sign for the durability of the current rally as the run of better-than-feared news may be coming to an end. The outlook on tariffs is now probably as good as it’s going to get. Inflation is likely to head higher for the rest of the year. And attention is turning to the budget bill working its way through Congress which will highlight the federal government’s unsustainable finances.

In the end, the inevitable steps necessary to fix the federal budget (or the market’s reaction to a failure to take such steps) may be what ultimately brings the economic data back into alignment with consumer sentiment.

Source: YCharts ; https://fred.stlouisfed.org/ ; data.sca.isr.umich.edu ; AOWM Calculations

TIPS | The ultimate turtle

May 12, 2025

Joining the rebound in stocks, crypto currencies are also surging higher again, which is indicative of the speculative wind still blowing through the financial markets. And while stock valuations are off their highs, they remain elevated – far from being washed out and increasing the probability that a passive investment in US stocks will offer meager real, inflation-adjusted returns over the next decade.

In such an environment, Treasury Inflation-Protected Securities (TIPS) may be the ultimate slow-and-steady investment with long-term real yields above 2%. TIPS are also likely to outperform nominal Treasurys as the current breakeven inflation rate has rarely been achieved over long periods of time in the modern era of fiat money and seems more dubious given the temptation or ultimate necessity to inflate away a good portion of the federal debt.

Investors are currently pricing financial assets with the firm expectation that the Fed will remain independent and able to deliver low inflation. If instead the central bank is co-opted to keep the federal government’s borrowing cost low, TIPS could turn into a turbocharged turtle of an investment.

Source: YCharts ; coin.dance/stats/marketcaphistorical ; shillerdata.com ; https://fred.stlouisfed.org/ ; AOWM Calculations

Economic Data | Good enough for now

May 5, 2025

The stock market shrugged off the decline of GDP in the first quarter and marched steadily higher last week. On Friday, the S&P 500 Index notched its ninth up day in a row – its longest winning streak in over twenty years. Stocks have swiftly recovered from their April swoon, even as expectations for economic growth and profits have begun to retreat.

The negative GDP print was easy for investors to look past as it was largely driven by a surge in imports in front of looming tariffs. Personal consumption – the real engine of the US economy – continued to expand at a solid clip in the first quarter, further bolstering hopes the economy is strong enough to power through the current moment. And the labor market remained in good enough shape to slightly temper expectations for fed rate cuts this year.

However, with unsustainable government stimulus waning and the private sector at least temporarily slowed by uncertainty around tariffs, future economic data may be harder to spin in a positive direction.

Source: YCharts ; Wall Street Journal ; S&P ; www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html ; https://fred.stlouisfed.org/ ; AOWM Calculations

Volatility | Unlikely to die down

April 28, 2025

The stock market continued its rollercoaster April last week, and the volatility is unlikely to die down in the coming days, which are packed with several companies reporting earnings as well as the release of the initial estimate for economic growth in the first quarter and the jobs report for April.

While the economic data remains generally positive, the outlook has turned lower. Earnings expectations for the next year have begun to be revised down (although analysts still expect strong double-digit growth). And forecasters have trimmed their projections for economic growth and increased the odds of a recession (though most prognosticators still think that will be avoided). The market volatility is indicative of the heightened sense of uncertainty on many fronts.

Despite the strong gains last week, the S&P 500 remains below its 200-day moving average. Long-term moving averages can help filter out the noise and indicate the underlying directional mood of the market – serving as a buy signal in an up market and a sell signal in a down market. How the market responds when it next reaches its 200-day moving average may portend whether the current uncertainty will be resolved in a positive or negative direction.

Source: YCharts, https://fred.stlouisfed.org/ , AOWM Calculations

US Dollar | Under pressure

April 21, 2025

The US dollar continued to trade lower last week. An index of the dollar relative to major currencies is down nearly 10% from its January high and is back near the low end of its trading range in recent years. The speed of the decline in the dollar’s value, which accelerated after the tariff announcement, is unusual but not unprecedent. And the dollar has had far larger long-term moves over the past sixty years.

As with any financial market, the machinations of the currency markets are mysterious, and theories abound to explain the potentially inexplicable. With respect to the effect of tariffs, one could make a case that they will eventually cause the dollar to appreciate as other countries seek to depreciate their currencies to offset the tariffs and/or imports decline decreasing the supply of dollars circulating internationally. Or one could argue that tariffs will lead the dollar to depreciate as they decrease international demand for US investments, which seems to have been the initial response.

Regardless of what tariffs might do, government officials have sent mixed messages as to whether the current Administration wants a strong or weak dollar. Although, the president has been very clear that he would like the Fed to follow the lead of other central banks and cut interest rates, which would likely put further downward pressure on the dollar.

Free-floating currencies will ultimately follow the market's mood often to extremes, and for now the mood is shifting away from the US.

Source: YCharts, https://fred.stlouisfed.org/ , The Economist (www.economist.com/topics/economic-and-financial-indicators) , AOWM Calculations

Bond Market | Signaling the beginning of the end?

April 14, 2025

Financial markets remained highly volatile last week. The stock market bounced back after the proposed tariffs were largely put on pause for 90 days, but the bond market sold off heavily as the 10-year Treasury yield jumped nearly half a percentage point – the largest weekly increase in long-term interest rates since 2001. The continued climb in the benchmark 10-year rate even after the release of an unexpectedly low CPI inflation report for March may merely be due to deleveraging by hedge funds, but it raises the specter that the implicit arrangement that the world has been operating under for decades may be beginning to end.

Since the 1980s, the US has been the consumer engine of the world economy. We have bought the world’s goods and run large trade deficits, while foreign savings has flowed into the US, lowering our interest rates and raising our asset prices. This in turn has incentivized us to save less and consume more foreign goods, which in turn has caused more foreign savings to flow in, further lowering our interest rates and raising our asset prices. Round and round, higher and higher. It was a mutually beneficial arrangement but one that, in concert with our own fiscal and monetary policies, also fostered an unsustainably low level of domestic savings.

Much as it is a chicken-and-egg story as to whether the trade deficit or the inflow of foreign savings came first at the start, the same could be said about the potential end. Domestic savings could be increased (e.g., by dramatically lowering the federal deficit) to reduce the trade deficit, or foreign capital could flow out first increasing domestic savings via the pull and push of higher interest rates and lower asset prices.

If long-term interest rates, especially real rates, continue to rise in the coming weeks in the face of a weakening economy, it will likely be a sign that foreign capital has decided to retreat first.

Source: YCharts, https://fred.stlouisfed.org/ , AOWM Calculations

Tariffs | Breaking investors' rose-colored glasses

April 7, 2025

The US stock market crossed the point where future returns were likely to be meager a long time ago. The only question has been whether those low returns would be realized via a relatively calm sideways march or a large market decline. Last week the odds of a market downturn increased with the announcement of much higher tariffs than expected.

The goal of the president’s tariff policy is unclear given conflicting statements by members of the administration, which makes it hard to gauge the ultimate effect. But crashing the stock market was undoubtedly not the intended purpose, thus the powers-that-be will likely offer some soothing words for investors in the coming days and weeks. And such swift market selloffs are usually followed by large up days and have historically proven short lived with stock prices significantly higher a year later.

However, investors' animal spirits may not be quickly revived this time as there are several differences between the current moment and the market volatility seen in 1987, 2008 and 2020. First, the economy is more sensitive to moves in the stock market than was the case just five years ago, so the market selloff could help prompt a recession. Second, market valuations are much higher than they were in those three previous periods, so the upside from here remains limited. Lastly and perhaps most importantly, the federal government is less well positioned or likely to unleash a tsunami of stimulus to boost the market.

Of particular note, unlike other periods of extreme volatility over the past forty years, Fed policymakers showed no inclination last week to step in to calm the market. If the downside volatility persists, that may change, but a Fed constrained in any way by high inflation would be a truly discombobulating adjustment for investors.

Source: YCharts, https://fred.stlouisfed.org/ , www.cmegroup.com/ , AOWM Calculations

The Economy & Market | Where to from here?

March 31, 2025

Higher than expected inflation data even before a potential tariff war commences kept downward pressure on the stock market last week. Sentiment has swung swiftly from invincible optimism to vulnerable apprehension about the future. The 2020s have been punctuated by unusual periods of high uncertainty and volatility, and the current moment certainly qualifies as one.

Wherever we go from here, the market and economy are apt to head in similar directions in the coming months. When a recession is averted, stock market corrections typically don’t manifest into prolonged, deep downturns. And the economy continued to hum along through the end of last year. The Bureau of Economic Analysis reported last week that real Gross Domestic Income surged in the fourth quarter at an annualized rate of 4.5% and corporate profits remained robust – which makes an imminent recession seem unlikely.

However, economic projections are even more useless than usual in the present environment. What can be said with some confidence is that profit margins are poised to come under pressure in the coming years one way or another. Given the still high valuations placed on current high profit margins, the market reaction to the direction the economy takes is likely to be muted on the upside and amplified on the downside.

Source: YCharts, https://fred.stlouisfed.org/ , Schwab , AOWM Calculations

The Fed's Outlook | 2% always on the horizon

March 25, 2025

Federal Reserve policymakers once again pushed off when they anticipate achieving their 2% inflation target with inflation now expected to run above that level through 2026. Nevertheless, the central bank still projected lowering its target overnight interest rate by half a percentage point before the end of the year and by another half a point next year. The Fed also announced that it was slowing the run off of its balance sheet to a trickle starting in April.

While tariff concerns have pushed inflation forecasts higher, policymakers appear unlikely to tighten policy in response to any tariff-induced price increases in the belief that the inflation would be transitory. Despite the Fed having a bad track record with such projections, investors continue to give policymakers the benefit of the doubt and cheer the prospects of lower interest rates.

The rising price of gold might be one of the few market indicators flashing a warning about future inflation. But that may be less a sign of near-term inflation concerns than a symptom of the global financial system moving slowly away from the US dollar as the world’s reserve currency – which could increase inflationary pressures down the road.

Source: YCharts, https://fred.stlouisfed.org/ , www.gold.org/goldhub/data/gold-demand-by-country , AOWM Calculations

Inflation | Increasingly divergent outlooks

March 17, 2025

CPI inflation moderated slightly in February, but forecasts for future inflation are increasingly divergent. The threat of tariffs has some consumers bracing for a resurgence of high inflation. Others believe either that the proposed tariffs are just a negotiating tactic that will ultimately lead to lower tariffs everywhere or that any negative effects of the tariffs will be more than offset by other pro-business policies.

There’s also the contingent who think tariffs won’t be inflationary because they will tip the economy into a recession. However, history would suggest that a recession will not immediately lead to lower inflation. Indeed, an inflation shock from tariffs that led to a recession would fit the historical pattern well with inflation potentially falling when the economy is on the rebound and price increases from tariffs have levelled off.

In the short run, the government deficit also continues to put upward pressure on inflation, and a recession is only likely to exacerbate that problem. Inevitable fiscal tightening could help lower inflation for a time; however, the federal debt looms ever larger and will quietly bias policymakers in the years to come towards letting inflation run hot. Central bankers will be reticent to ever explicitly target high inflation. Instead, they are likely to pay lip service to inflation concerns while suppressing real yields in the spirit of helping to finance the federal debt.

Thus, inflation is poised to be higher than investors are anticipating over the next decade, though with luck not as bad as some now fear.

Source: YCharts, https://fred.stlouisfed.org/ , https://data.sca.isr.umich.edu/ , AOWM Calculations

Uncertainty | Making a recession more certain

March 10, 2025

The economic data continues to be generally good. The unemployment rate remains low at 4.1%, and the economy added jobs in February for the 50th consecutive month. However, a side effect of the fast pace of change emanating from the nation’s capital is a growing sense of uncertainty. After the election, business optimism increased with expectations for a more business-friendly administration that would cut taxes and regulations. The stock market rallied on that hope as well but has since given back all its post-election gains.

Uncertainty around tariffs, government downsizing, international relations, a potential government shutdown, and what policies will actually get through a closely divided Congress is weighing on business and consumer confidence and risks starting a negative domino effect that could lead to a recession. Moving fast and furiously is clearly part of the White House’s strategy with the belief that any resulting downturn will be short and shallow. But, no matter the party in power, the imbalances built up over several administrations were never likely to be unwound painlessly.

Source: YCharts, https://fred.stlouisfed.org/ , www.policyuncertainty.com , AOWM Calculations

The Economy | K-shaped Achilles' heel

March 3, 2025

The post-pandemic economy has been described as K-shaped with some doing well while others have struggled. The strong headline economic numbers have not created an era of good feelings outside of the financial markets. Surveys of consumers continue to reflect a dour mood that is at odds with reports of strong consumer spending.

The top-end of the income ladder, which also holds the most wealth and has benefited the most from the increase in asset valuations, has driven consumer spending the past couple of years. An analysis by Moody’s Analytics found that the top 10% of earners now account for half of consumer spending – the highest level over the period analyzed back to 1989.

If the economy does slip into a recession, for which concerns are again on the rise, and asset valuations normalize, the negative wealth effect could amplify the downturn more than has been the case in previous recessions, especially if inflation keeps the Fed from excessively juicing the financial markets as it has done in recent decades.

Source: YCharts, https://fred.stlouisfed.org/ , www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html , Moody's Analytics, Wall Street Journal, AOWM Calculations

Government Tailwinds | Fading slowly but loudly

February 24, 2025

The federal government is shrinking. How much and how fast is hard to tell. Quickly cutting government outlays could tip the economy into a recession, for which the financial markets are ill-prepared. Large government deficits have boosted the economy and corporate profits in recent years, and shrinking those deficits will be discombobulating, even if necessary for the long-run health of the nation.

However, truly changing the trajectory of the federal deficit will be challenging, so the fiscal stimulant is unlikely to be rudely taken away despite all the sound and fury. While the overall government tailwind for the economy will probably fade slowly, the noise coming from the nation’s capital still risks frightening the animal spirits most responsible for driving economic growth.

Source: YCharts, https://fred.stlouisfed.org/ , usafacts.org , cbo.gov , www.brookings.edu/articles/is-government-too-big-reflections-on-the-size-and-composition-of-todays-federal-government/ , AOWM Calculations

Inflation | Pressures persist

February 17, 2025

Inflation continued to pick back up in January with the Consumer Price Index (CPI) increasing at the fastest monthly rate since August 2023. Annual CPI inflation is back up to 3% and core CPI inflation remains stubbornly stuck around 3.3%. There are always one-time events that can explain inflation away, but the trend in recent months is indicative of inflationary pressures that have not been subdued.

High government deficits and elevated asset values are juicing aggregate demand beyond the economy’s limits. And the Fed has dubiously piled on additional stimulus by lowering its target overnight interest rate by 100 basis points last year.

While investors have increased their short-term inflation expectations, concerns about long-term inflation risks remain oddly non-existent. We are still on the optimistic side of the mountain where every cloud has a silver lining. Indeed, investors found in the internals of the inflation data sufficient encouraging news to boost the odds for a second Fed rate cut this year, mellow long-term interest rates, and send the S&P 500 back to within a whisker of its all-time high.

Source: YCharts, https://fred.stlouisfed.org/ , AOWM Calculations

Reality | Somewhere in the middle

February 10, 2025

Over the course of the recovery from the pandemic, the labor market data has been telling conflicting stories. Most glaringly, the monthly survey of businesses has shown solid growth in payrolls while the survey of households has shown stagnant growth in the number of employed individuals with declining full-time employment. Annual data revisions this month suggest that reality is somewhere in the middle as the payroll data was revised lower and a historically large increase in the population estimate due to immigration boosted the number of estimated employed individuals.

There are still plenty of underlying signs of potential weakness in the labor market. However, while clearly weaker than the real-time statistics had indicated, the revised payroll data was not as negative as expected, and the short-term trend in private payrolls is currently stronger than it has been for quite some time. It is unwise to read too much into a few data points, especially in light of recent large revisions. But, for now, the uptick in the payroll data, along with the downtick in the unemployment rate to 4%, is likely to keep the Fed comfortably on pause.

Source: YCharts, https://fred.stlouisfed.org/ , AOWM Calculations

The Question | Finally asked...

February 3, 2025

Fed policymakers met last week and paused their rate cuts, at least for the time being. On the surface, a pause was well justified (and the previous cuts questionable): GDP is estimated to be growing faster than the long-run limits of population and productivity growth; the unemployment rate remains low; inflation remains above the Fed’s 2% target; inflation expectations and long-term rates have trended higher in recent months; and asset valuations are at historical extremes.

Regarding those asset valuations, a reporter finally asked the Fed Chair about the large elephant in the room. While acknowledging that asset prices are “elevated by many metrics,” Jay Powell insisted “there’s a lot of resilience out there” to withstand a market downturn. A proclamation of “resilience” risks not aging well but also largely misses the point.

At the peak of the dotcom bubble in 2000, Alan Greenspan spoke frequently about the imbalances created when asset prices run well ahead of current income and the need for the Fed to be vigilant against the potential inflationary pressures. At the time, inflation appeared confusingly well-behaved. Greenspan identified the federal budget surplus and our ability to import labor, goods and capital from abroad as mitigating the excess demand produced by the wealth effect – factors Greenspan did not believe the Fed could depend on to restrain inflation indefinitely.

Today, the federal budget is exacerbating economic imbalances, and the other mitigating factors are being reined in by the current administration. This should make the Fed more vigilant against bubble-induced inflationary pressures than it was in 2000. It has not, but nor has there been much pressure to grapple with the question.

Source: YCharts, https://fred.stlouisfed.org/ , www.federalreserve.gov/newsevents/speech/2000speech.htm , AOWM Calculations